While the digital age has ushered in a myriad of technological services, Valuation Model Excel Template remain a classic and useful device for numerous facets of our lives. The tactile experience of connecting with these templates offers a sense of control and company that enhances our hectic, digital presence. From improving efficiency to aiding in imaginative searches, Valuation Model Excel Template continue to show that often, the easiest remedies are the most efficient.

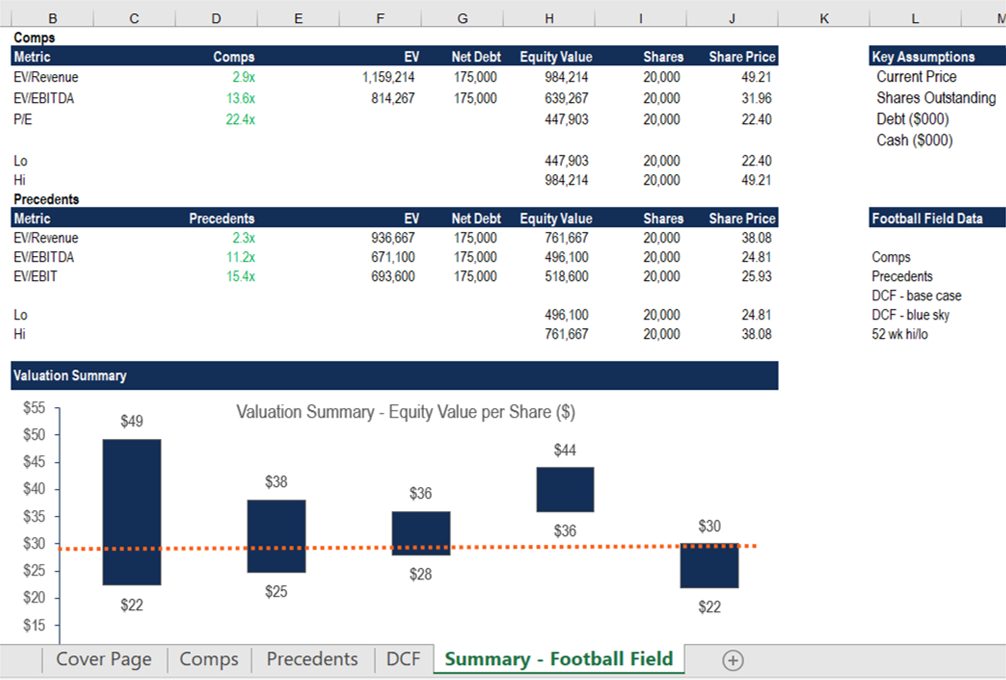

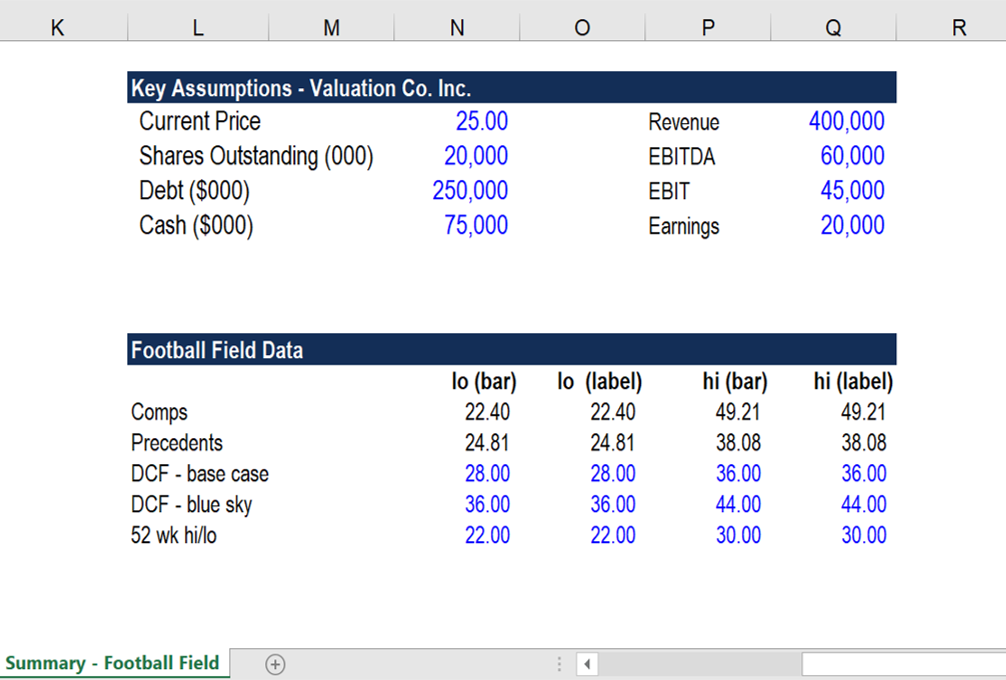

Valuation Analysis Excel Model Template Eloquens

Valuation Model Excel Template

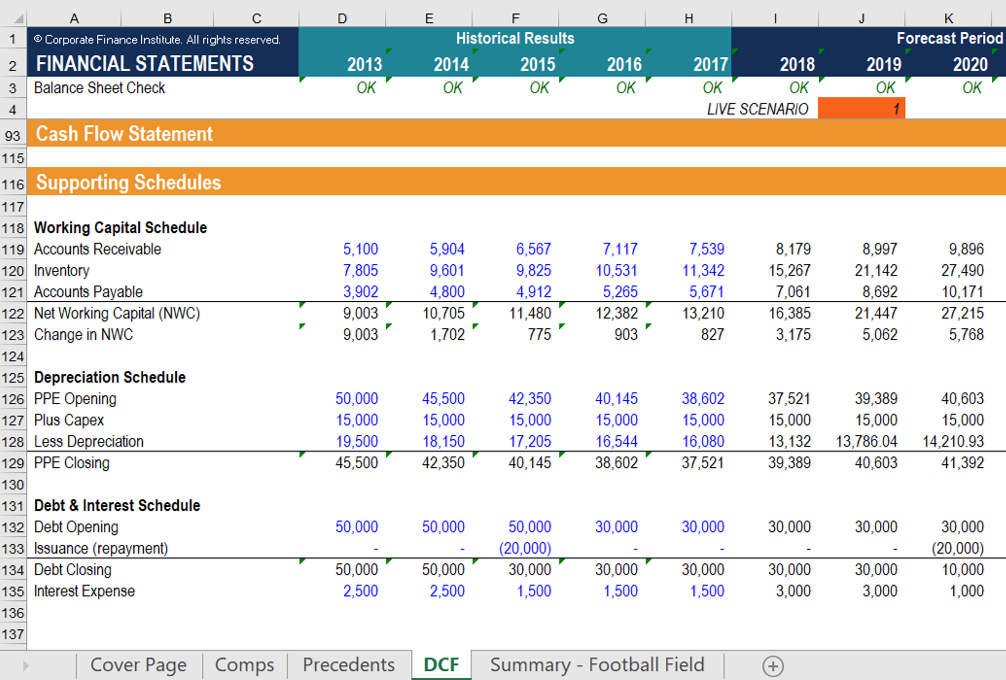

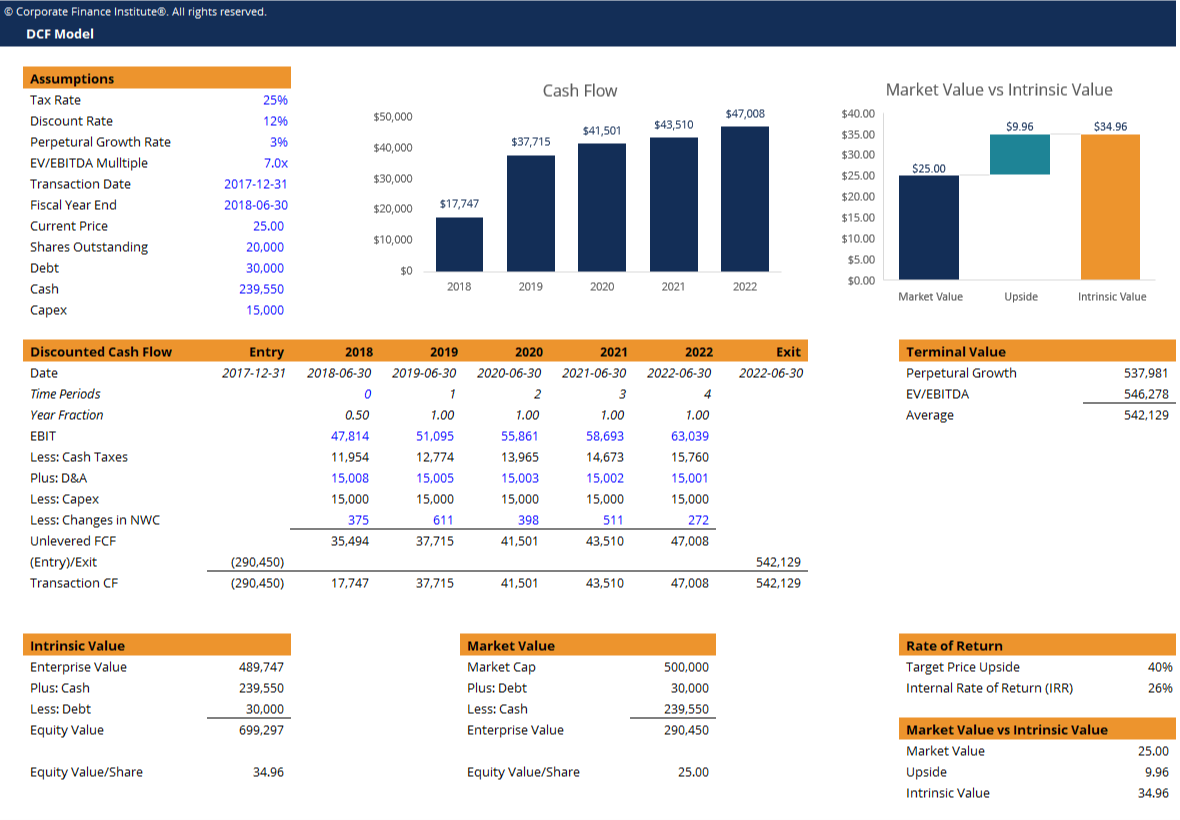

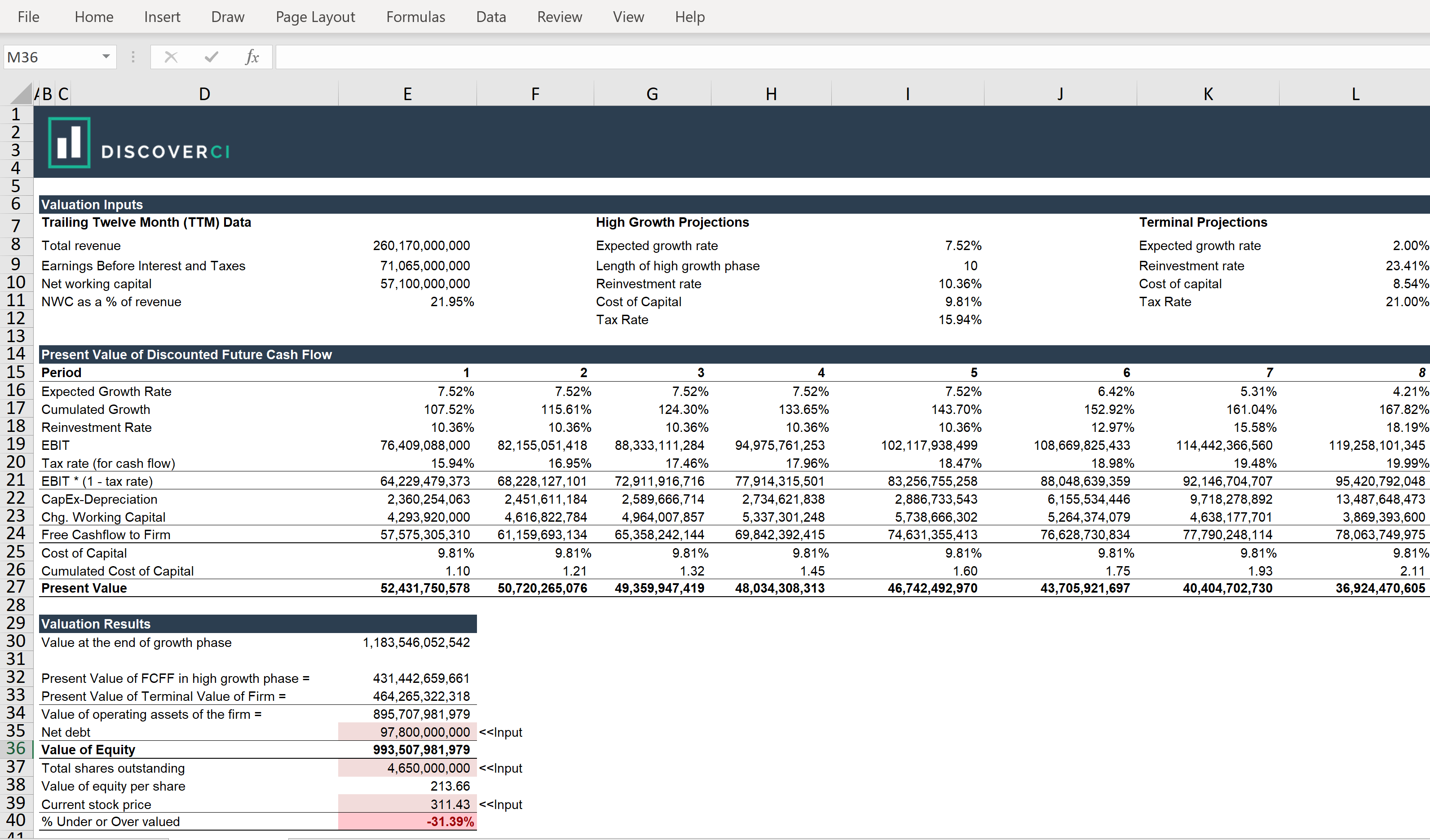

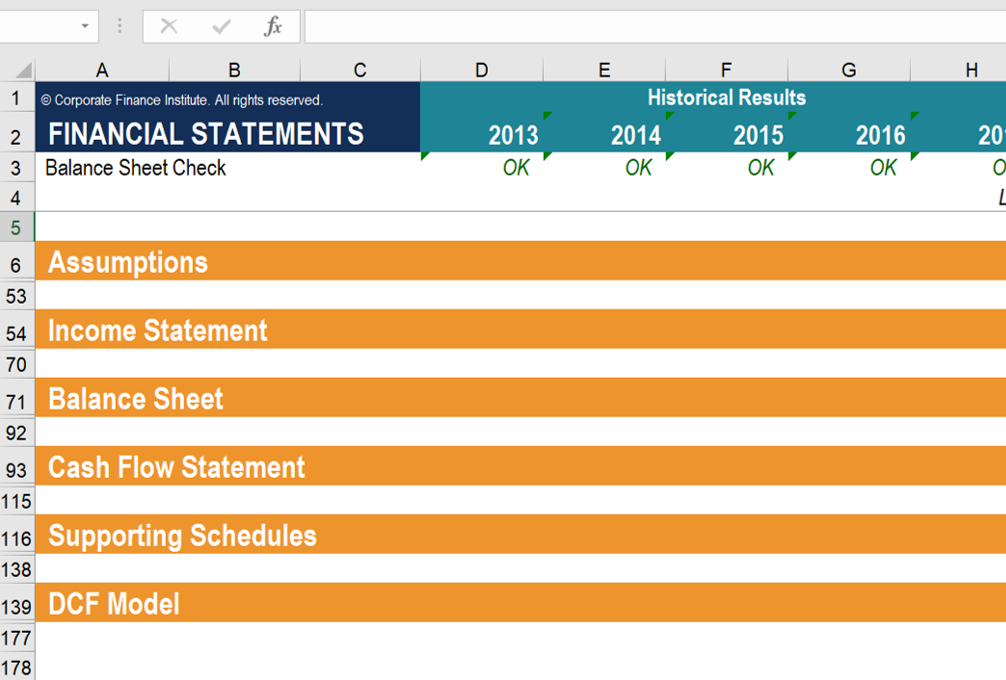

DCF Step 1 Build a forecast The first step in the DCF model process is to build a forecast of the three financial statements based on assumptions about how the business will perform in the future On average this forecast typically goes out about 5 years

Valuation Model Excel Template also find applications in health and wellness. Health and fitness organizers, meal trackers, and sleep logs are just a couple of instances of templates that can contribute to a healthier way of living. The act of literally completing these templates can infuse a sense of commitment and discipline in adhering to personal health objectives.

Net Present Value Excel Template

Net Present Value Excel Template

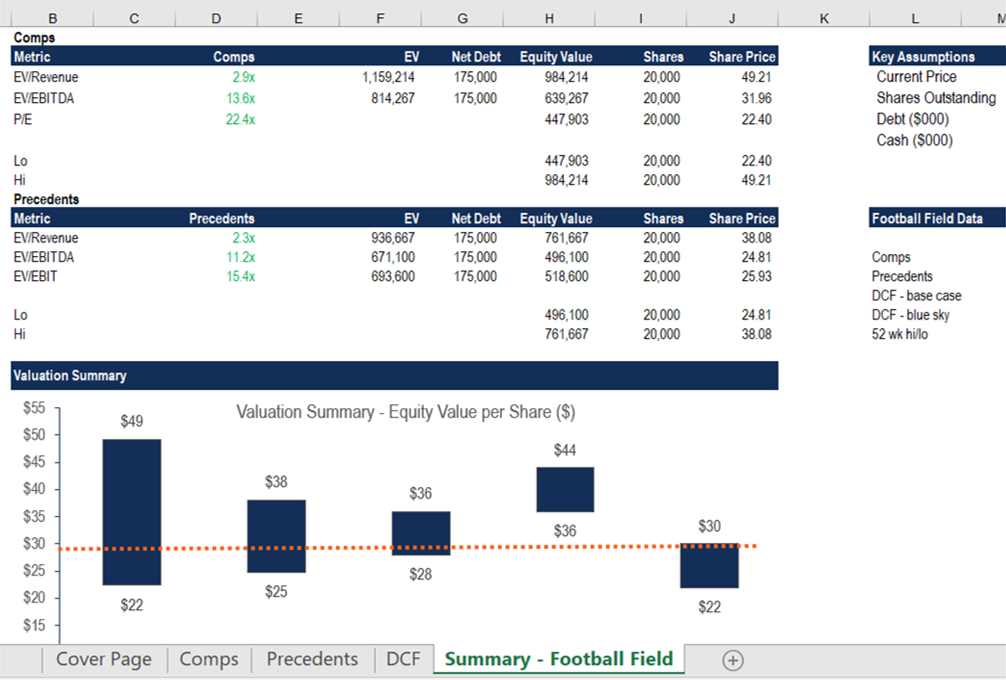

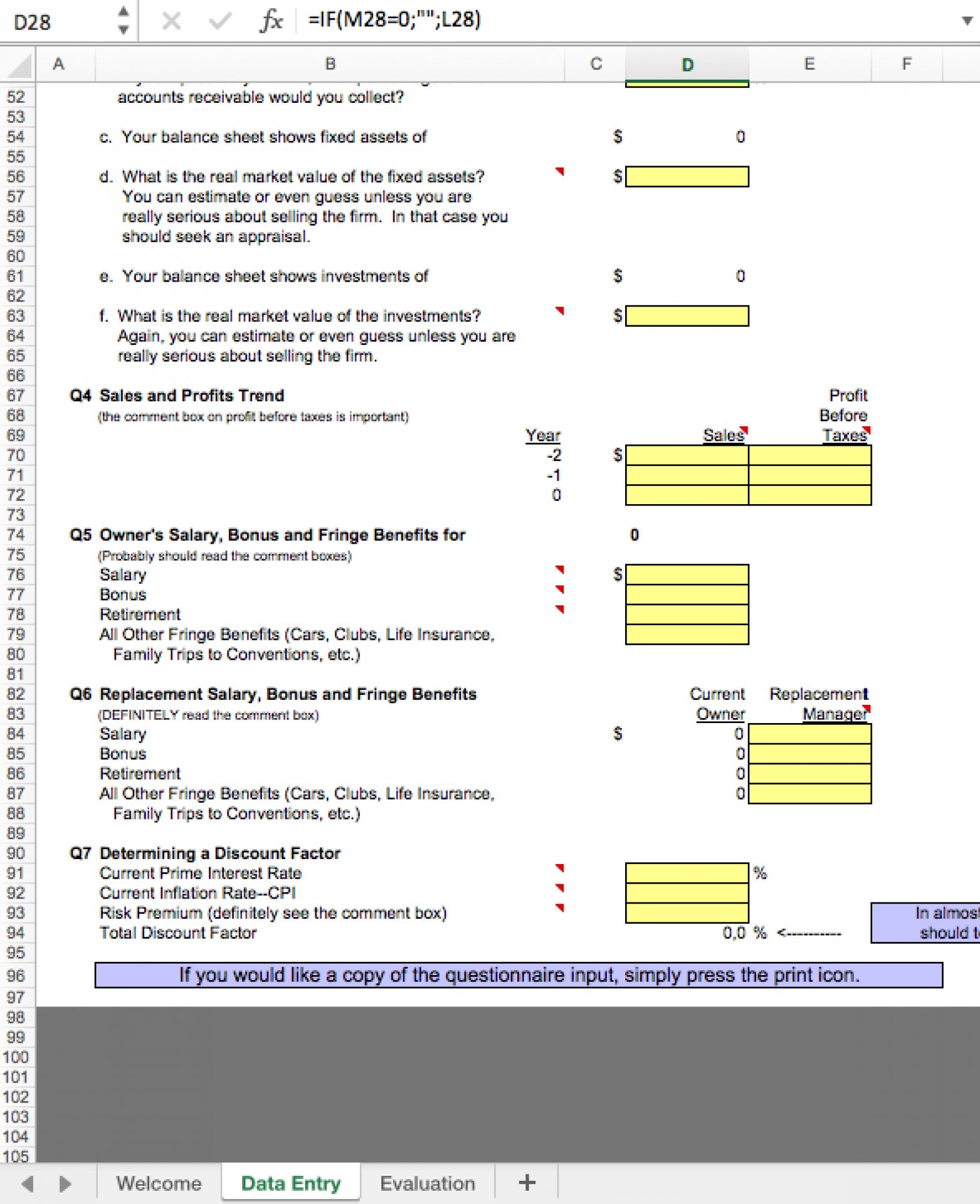

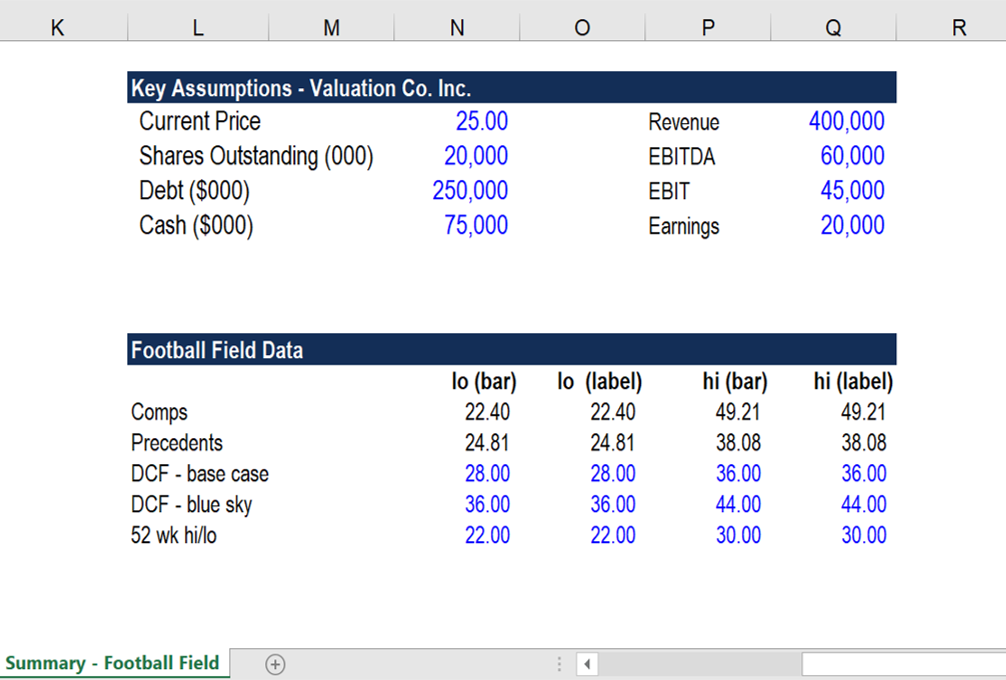

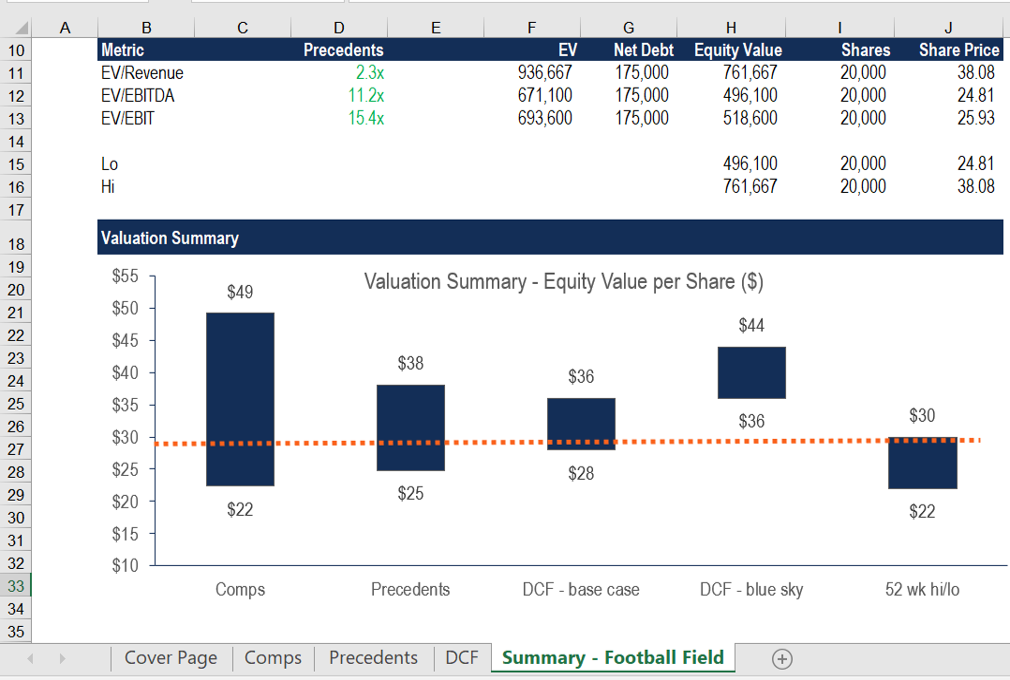

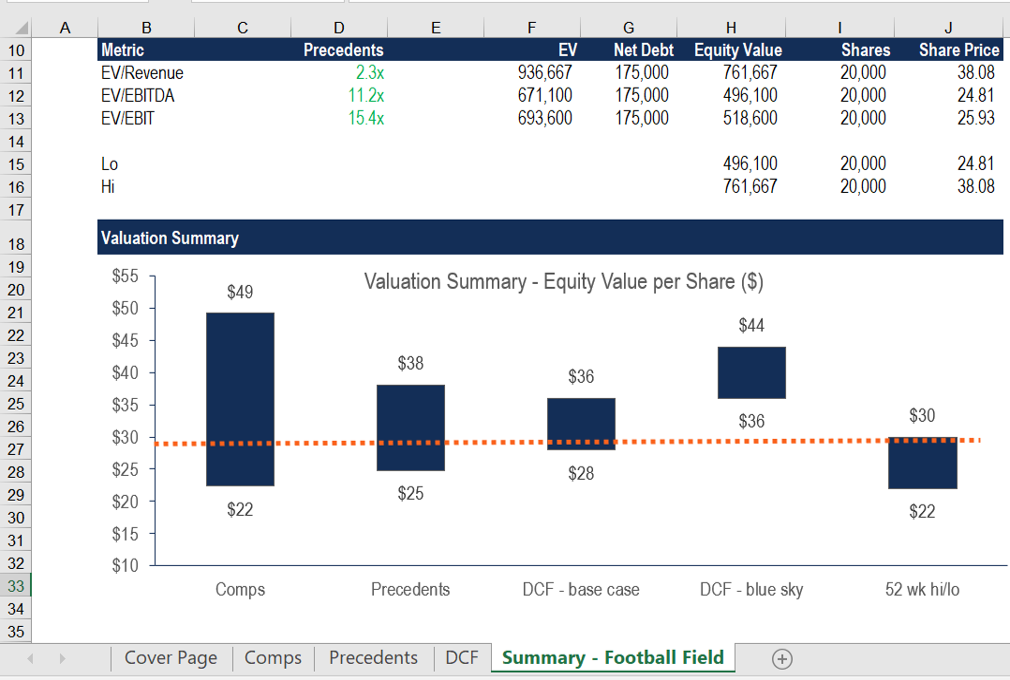

What is Valuation Modeling in Excel Valuation modeling refers to the forecasting and analysis using several different financial models It includes discounted cash flow DCF analysis precedent comparables and comparable trading multiples These financial models may be developed from the ground up in Excel or developed using existing templates

Artists, writers, and developers usually turn to Valuation Model Excel Template to boost their innovative tasks. Whether it's mapping out concepts, storyboarding, or intending a style layout, having a physical template can be an useful beginning point. The adaptability of Valuation Model Excel Template enables developers to iterate and fine-tune their job till they achieve the wanted result.

Discounted Cash Flow Excel Template Sample Templates Sample Templates

Discounted Cash Flow Excel Template Sample Templates Sample Templates

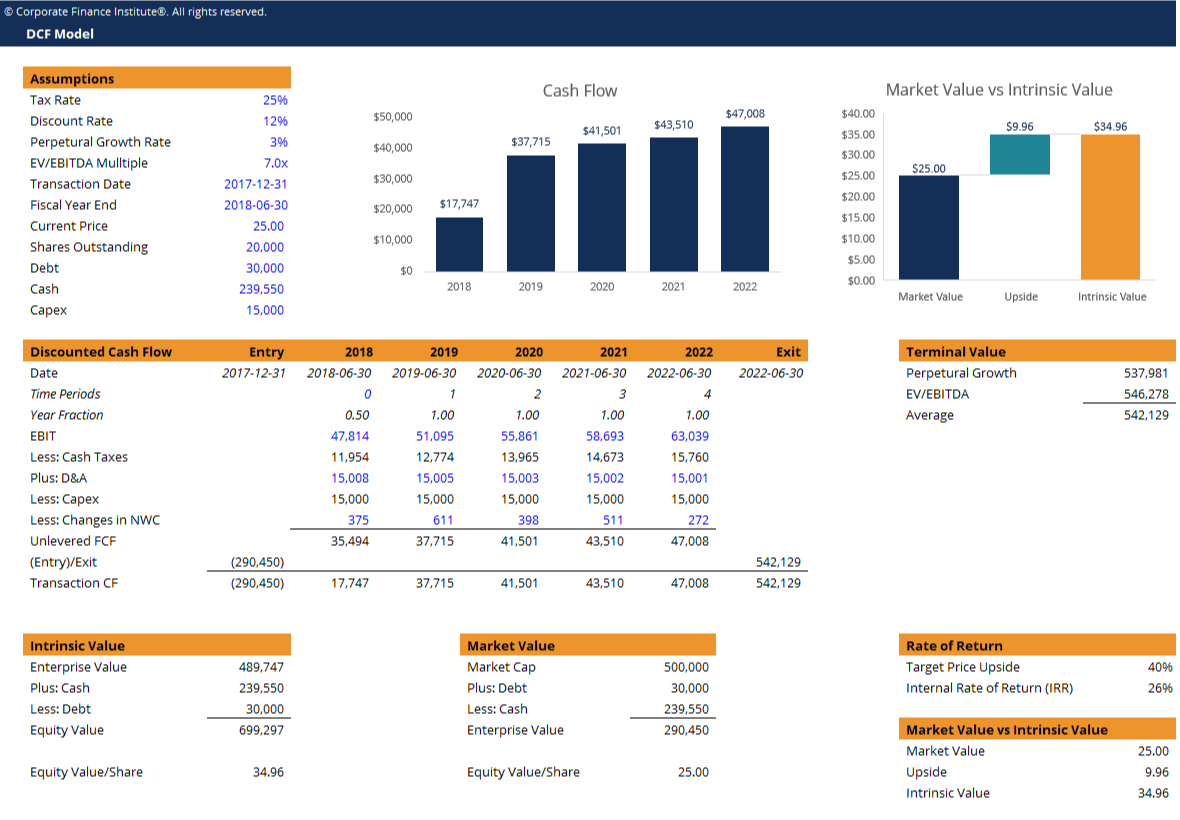

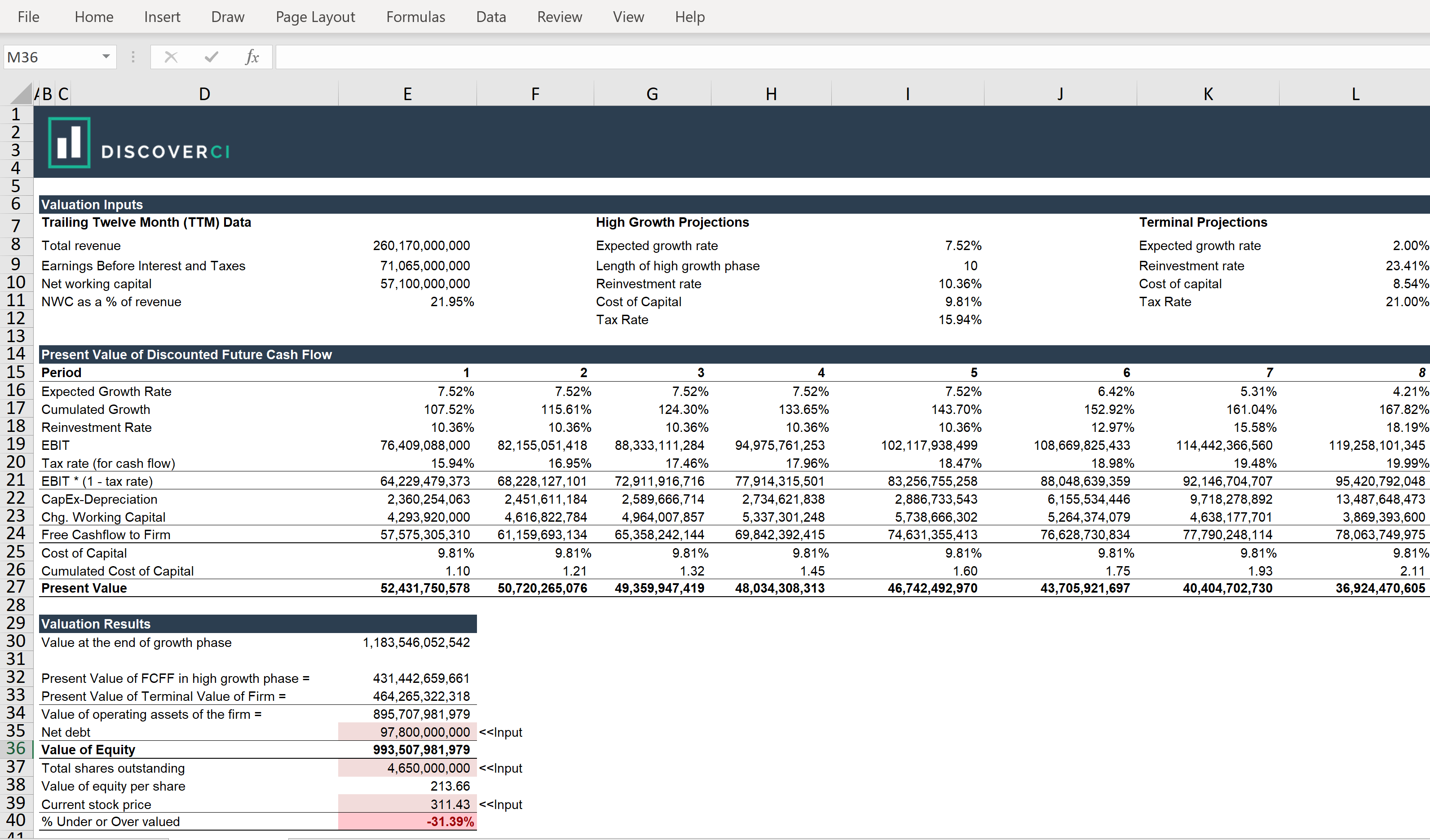

The Discounted Cash Flow Model or DCF Model is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current present value DCFs are widely used in both academia and in practice Valuing companies using a DCF model is considered a core skill for investment bankers private

In the professional realm, Valuation Model Excel Template use an efficient method to handle jobs and projects. From organization plans and task timelines to billings and cost trackers, these templates improve crucial company procedures. Additionally, they supply a tangible document that can be conveniently referenced during conferences and presentations.

Valuation Analysis Excel Model Template Eloquens

Valuation Analysis Excel Model Template Eloquens

3 Statement Financial Model Download WSO s free 3 statement financial model to understand how the income statement balance sheet and cash flow are linked Debt Schedule Template Download WSO s free debt schedule template to model for debt obligations and understand the affect of debt on valuations Free Cash Flow to Equity FCFE

Valuation Model Excel Template are widely made use of in educational settings. Teachers commonly count on them for lesson strategies, classroom tasks, and rating sheets. Students, also, can benefit from templates for note-taking, study timetables, and task preparation. The physical visibility of these templates can enhance engagement and act as substantial help in the discovering process.

Here are the Valuation Model Excel Template

https://corporatefinanceinstitute.com/resources/financial-modeling/dcf-model-template/

DCF Step 1 Build a forecast The first step in the DCF model process is to build a forecast of the three financial statements based on assumptions about how the business will perform in the future On average this forecast typically goes out about 5 years

https://www.wallstreetoasis.com/resources/financial-modeling/valuation-modeling-in-excel

What is Valuation Modeling in Excel Valuation modeling refers to the forecasting and analysis using several different financial models It includes discounted cash flow DCF analysis precedent comparables and comparable trading multiples These financial models may be developed from the ground up in Excel or developed using existing templates

DCF Step 1 Build a forecast The first step in the DCF model process is to build a forecast of the three financial statements based on assumptions about how the business will perform in the future On average this forecast typically goes out about 5 years

What is Valuation Modeling in Excel Valuation modeling refers to the forecasting and analysis using several different financial models It includes discounted cash flow DCF analysis precedent comparables and comparable trading multiples These financial models may be developed from the ground up in Excel or developed using existing templates

Net Present Value Excel Template

Valuation Analysis Excel Model Template Eloquens

Valuation Analysis Excel Model Template Eloquens

Valuation Analysis Excel Model Template Eloquens

Valuation Analysis Excel Model Template Eloquens

DCF Model Tutorial With Free Excel Business valuation

DCF Model Tutorial With Free Excel Business valuation

Three Statement Financial Excel Models Valuation Financial Modeling Excel Financial