While the electronic age has actually introduced a myriad of technological options, Depreciation Format In Excel As Per Income Tax remain a classic and functional tool for different elements of our lives. The tactile experience of engaging with these templates offers a sense of control and company that complements our fast-paced, electronic existence. From enhancing performance to helping in creative searches, Depreciation Format In Excel As Per Income Tax remain to verify that sometimes, the simplest options are the most efficient.

Tax Laptop Depreciation Calculator ClariceMalath

Depreciation Format In Excel As Per Income Tax

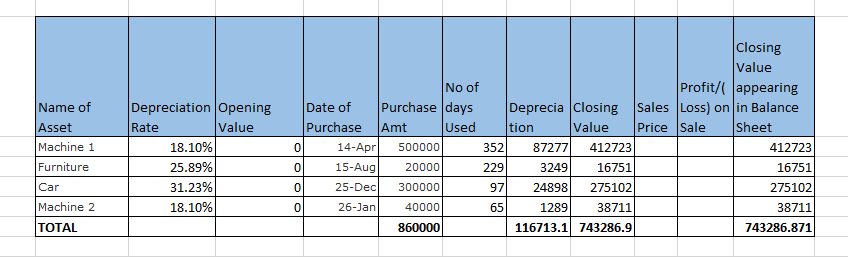

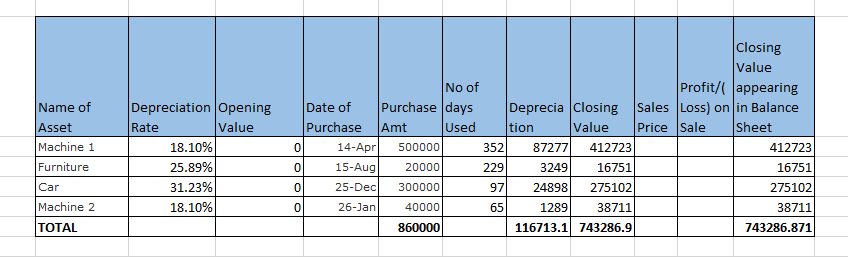

The Calculator is in Excel Format and it helps in Calculating depreciation as per Rates Prescribed under Rule 5 of Income Tax Rules Read with Section 32 of Income Tax Act

Depreciation Format In Excel As Per Income Tax also locate applications in wellness and wellness. Physical fitness coordinators, dish trackers, and sleep logs are just a few instances of templates that can add to a healthier lifestyle. The act of literally filling out these templates can infuse a sense of commitment and discipline in sticking to personal wellness objectives.

Depreciation Rate Chart As Per Income Tax For F Y 2017 18 2018 19

Depreciation Rate Chart As Per Income Tax For F Y 2017 18 2018 19

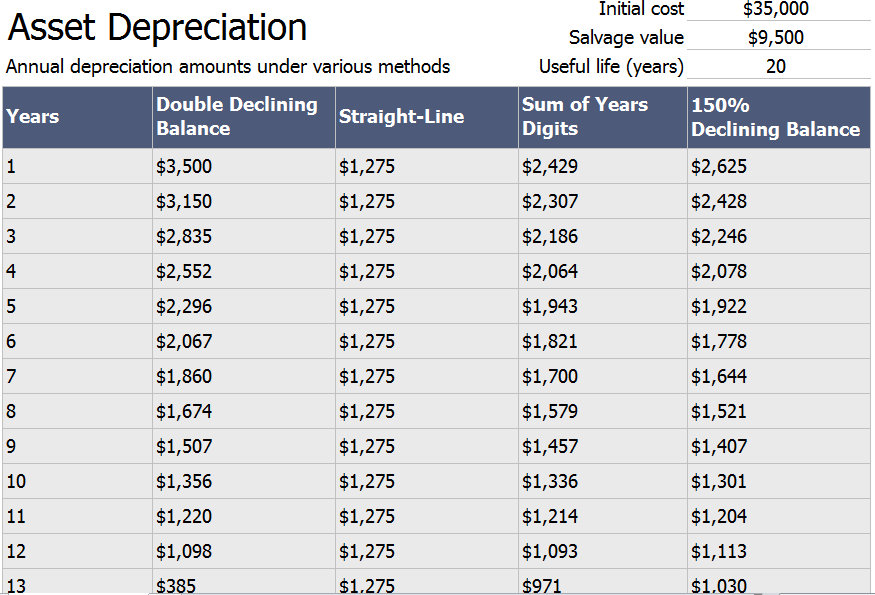

The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation The unit used for the period must be the same as the unit used for the life e g years months etc

Artists, writers, and developers often turn to Depreciation Format In Excel As Per Income Tax to boost their innovative projects. Whether it's laying out concepts, storyboarding, or intending a style layout, having a physical template can be an useful beginning point. The adaptability of Depreciation Format In Excel As Per Income Tax enables creators to iterate and improve their job up until they accomplish the wanted outcome.

Cost For Latest Version Of Excel Fecolswap

Cost For Latest Version Of Excel Fecolswap

It is very simple to calculate depreciation also additional depreciation with every assets calculate automatic depreciation xlsx

In the professional world, Depreciation Format In Excel As Per Income Tax supply a reliable method to take care of jobs and projects. From organization plans and project timelines to invoices and cost trackers, these templates improve important organization processes. Additionally, they give a tangible document that can be easily referenced during conferences and presentations.

Depreciation Schedule Template Excel Free Free Printable Templates

Depreciation Schedule Template Excel Free Free Printable Templates

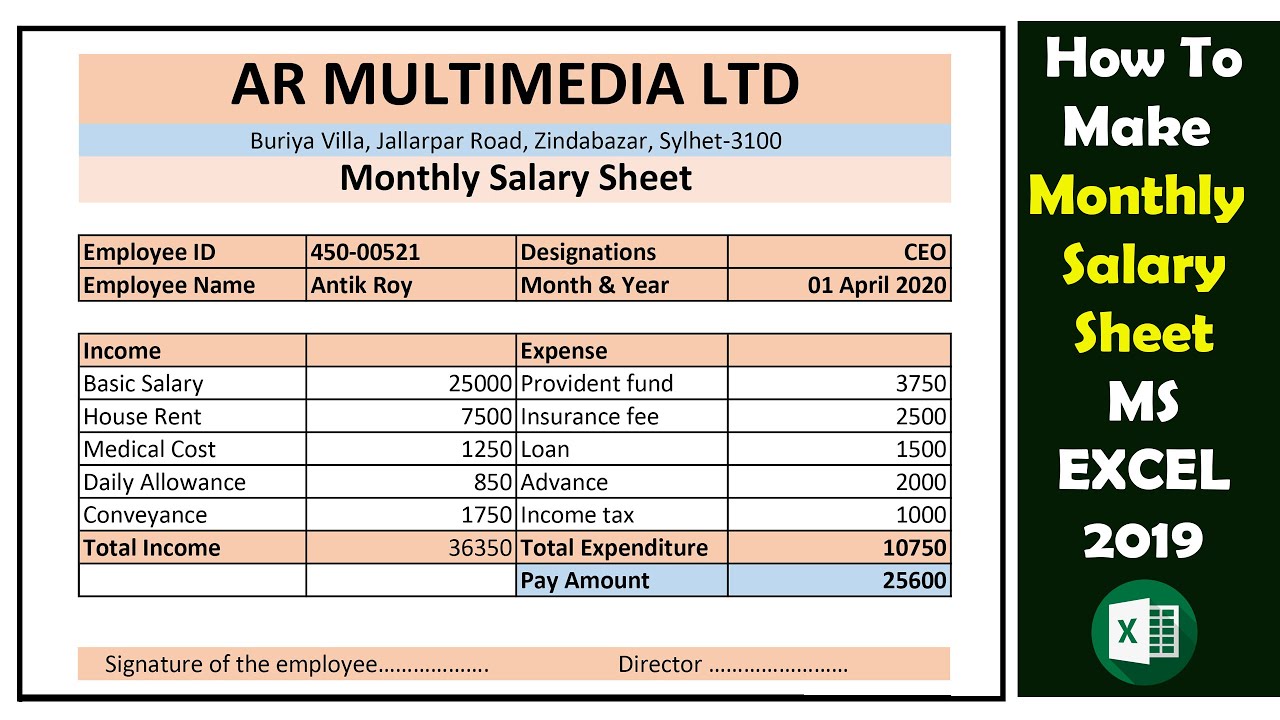

Calculation of Income from Salary and Filing their Income Tax Return Faiz Aamir INR 199

Depreciation Format In Excel As Per Income Tax are extensively made use of in educational settings. Teachers often rely on them for lesson plans, class tasks, and grading sheets. Students, too, can take advantage of templates for note-taking, study timetables, and job planning. The physical existence of these templates can enhance interaction and serve as substantial aids in the discovering process.

Download Depreciation Format In Excel As Per Income Tax

https://taxguru.in › income-tax

The Calculator is in Excel Format and it helps in Calculating depreciation as per Rates Prescribed under Rule 5 of Income Tax Rules Read with Section 32 of Income Tax Act

https://www.journalofaccountancy.com › issues › ...

The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation The unit used for the period must be the same as the unit used for the life e g years months etc

The Calculator is in Excel Format and it helps in Calculating depreciation as per Rates Prescribed under Rule 5 of Income Tax Rules Read with Section 32 of Income Tax Act

The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation The unit used for the period must be the same as the unit used for the life e g years months etc

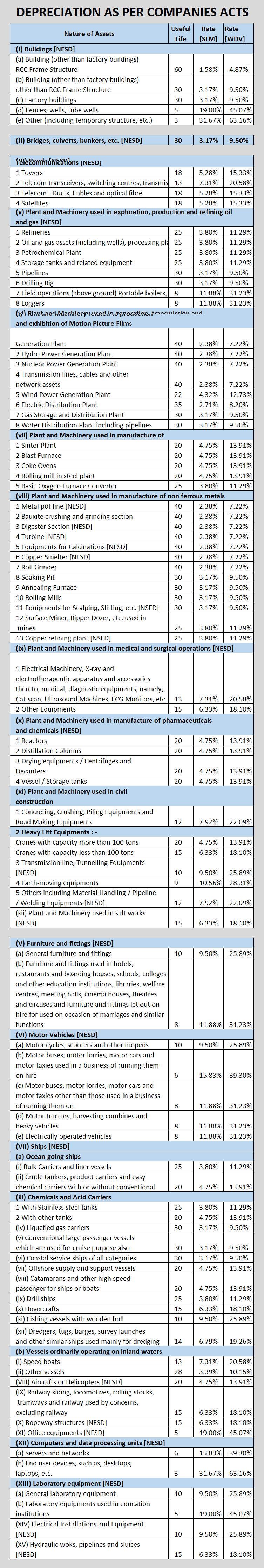

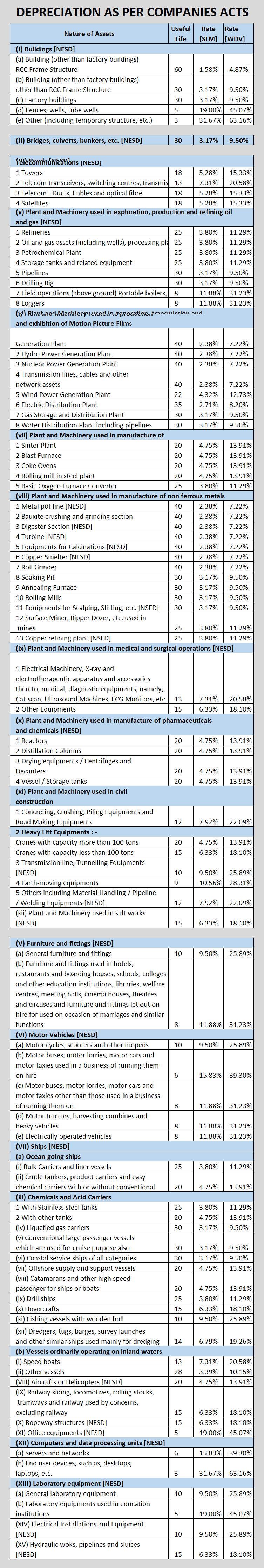

Depreciation As Per Companies Act Assignment Depreciation Chart

Calculate My Income Tax SuellenGiorgio

Printable Income Statement

How To Calculate Depreciation As Per Companies Act Haiper

Fixed Asset Depreciation Excel Spreadsheet Template124

Depreciation Rates Chart Under Companies Act 2013

Depreciation Rates Chart Under Companies Act 2013

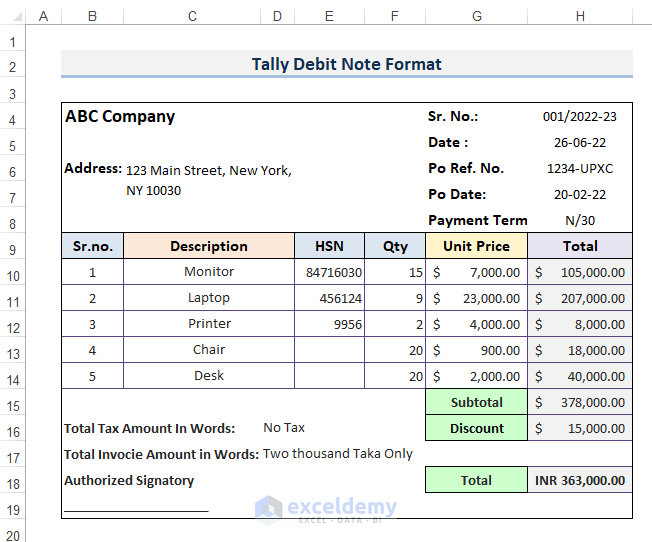

How To Create Tally Debit Note Format In Excel With Easy Steps