While the digital age has ushered in a huge selection of technological solutions, Company Tax Return Example continue to be an ageless and useful device for different facets of our lives. The responsive experience of communicating with these templates offers a sense of control and company that complements our hectic, electronic presence. From improving efficiency to aiding in innovative searches, Company Tax Return Example continue to show that occasionally, the simplest options are one of the most efficient.

Attorney General Advice Pdf

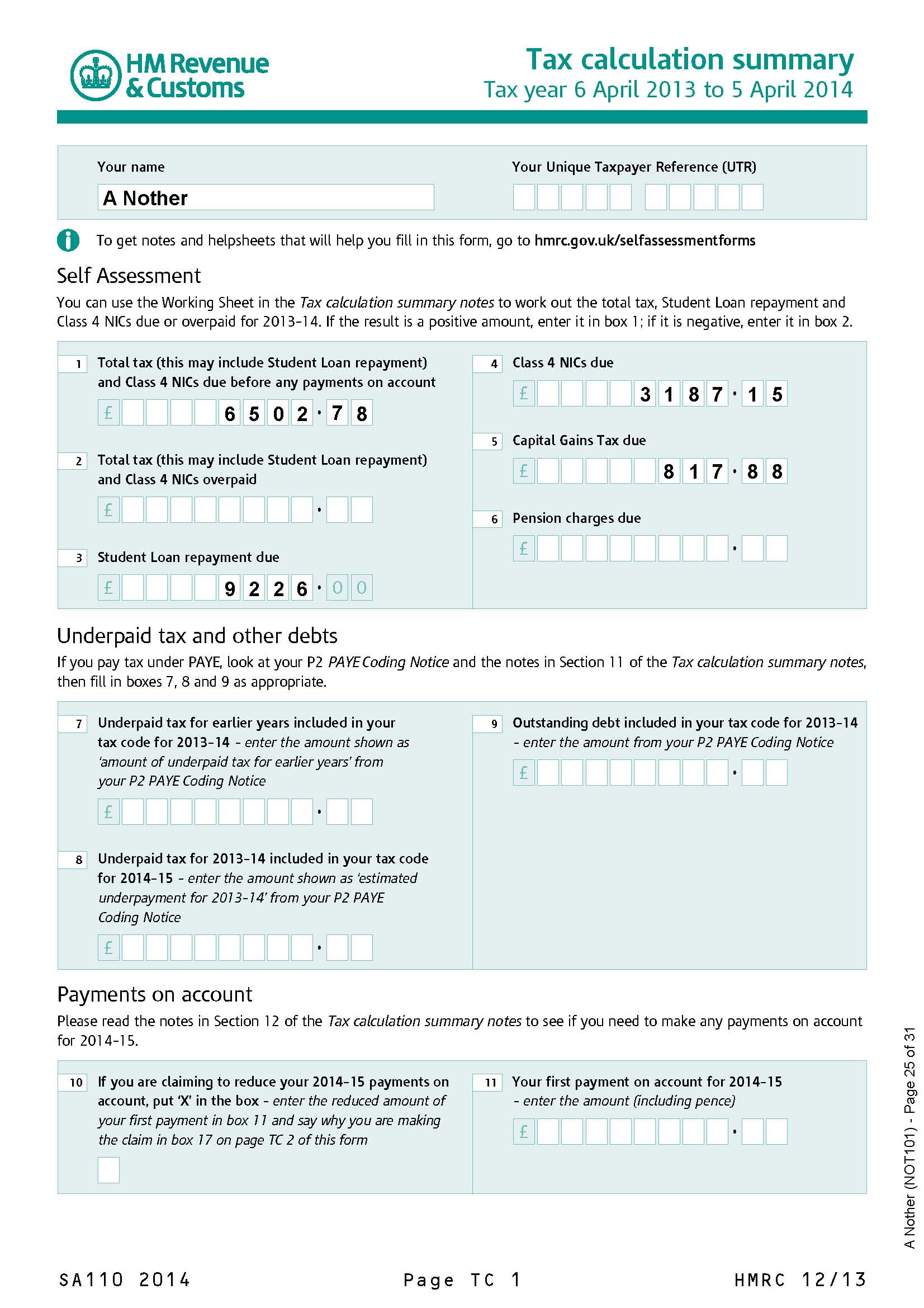

Company Tax Return Example

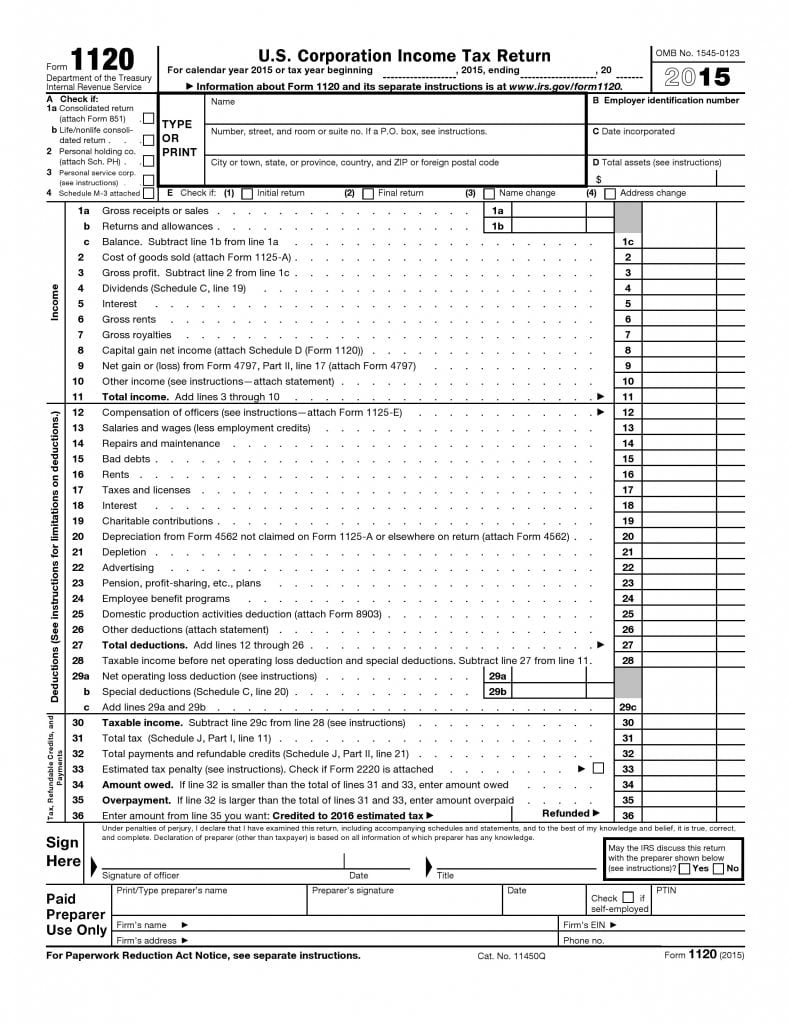

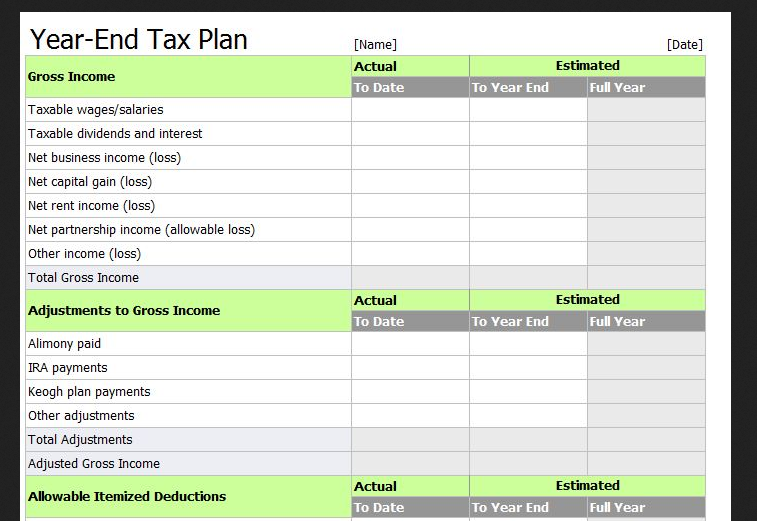

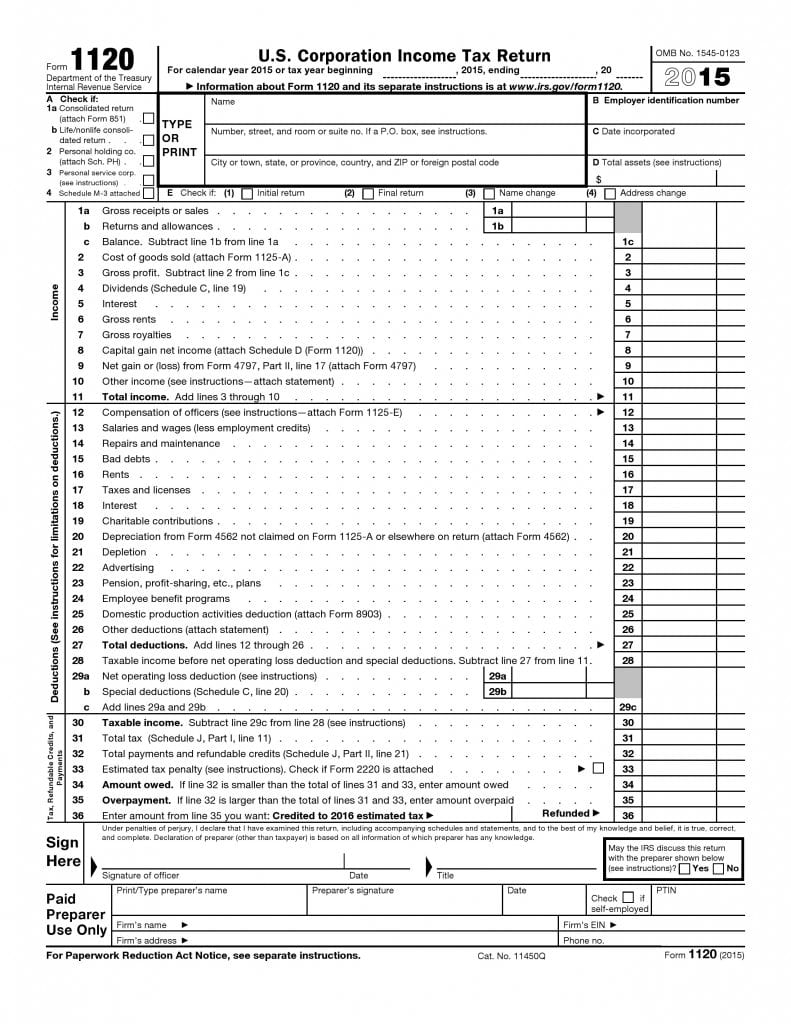

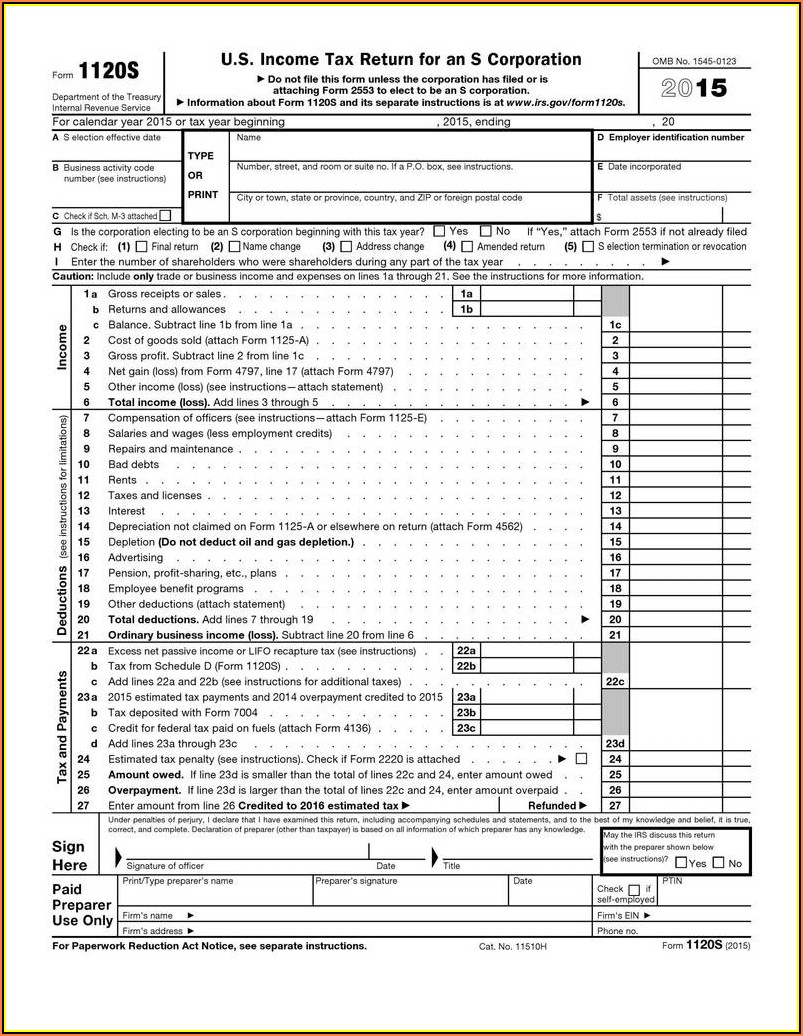

Determine the type of corporation 2 Determine tax deductions for write offs 3 Pay estimated taxes to the IRS 4 File federal return by due date 5 File state tax returns by due date 6 File local tax returns by due date 7 File international taxes for any business in other countries

Company Tax Return Example also find applications in health and wellness. Physical fitness organizers, dish trackers, and rest logs are simply a couple of examples of templates that can add to a healthier lifestyle. The act of literally filling out these templates can impart a feeling of commitment and technique in sticking to individual wellness goals.

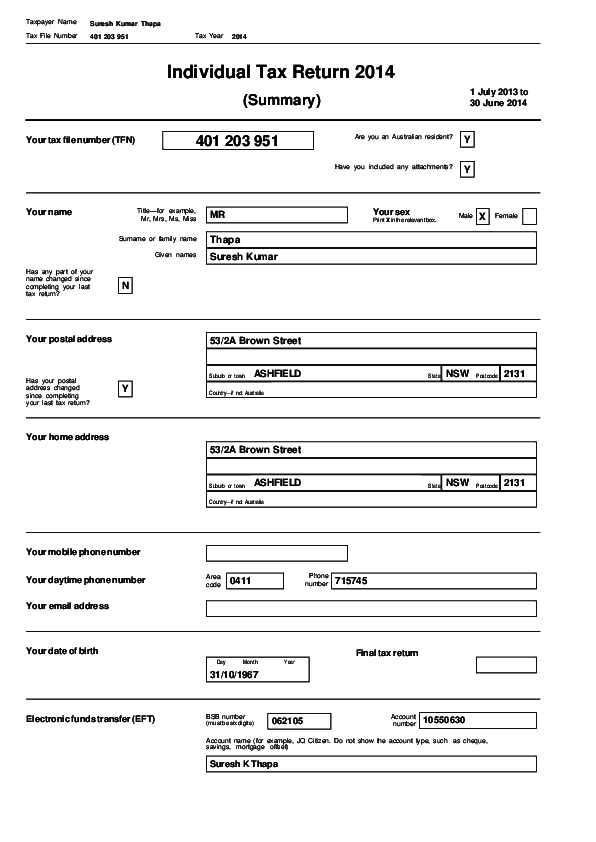

Tax Return Bank2home

Tax Return Bank2home

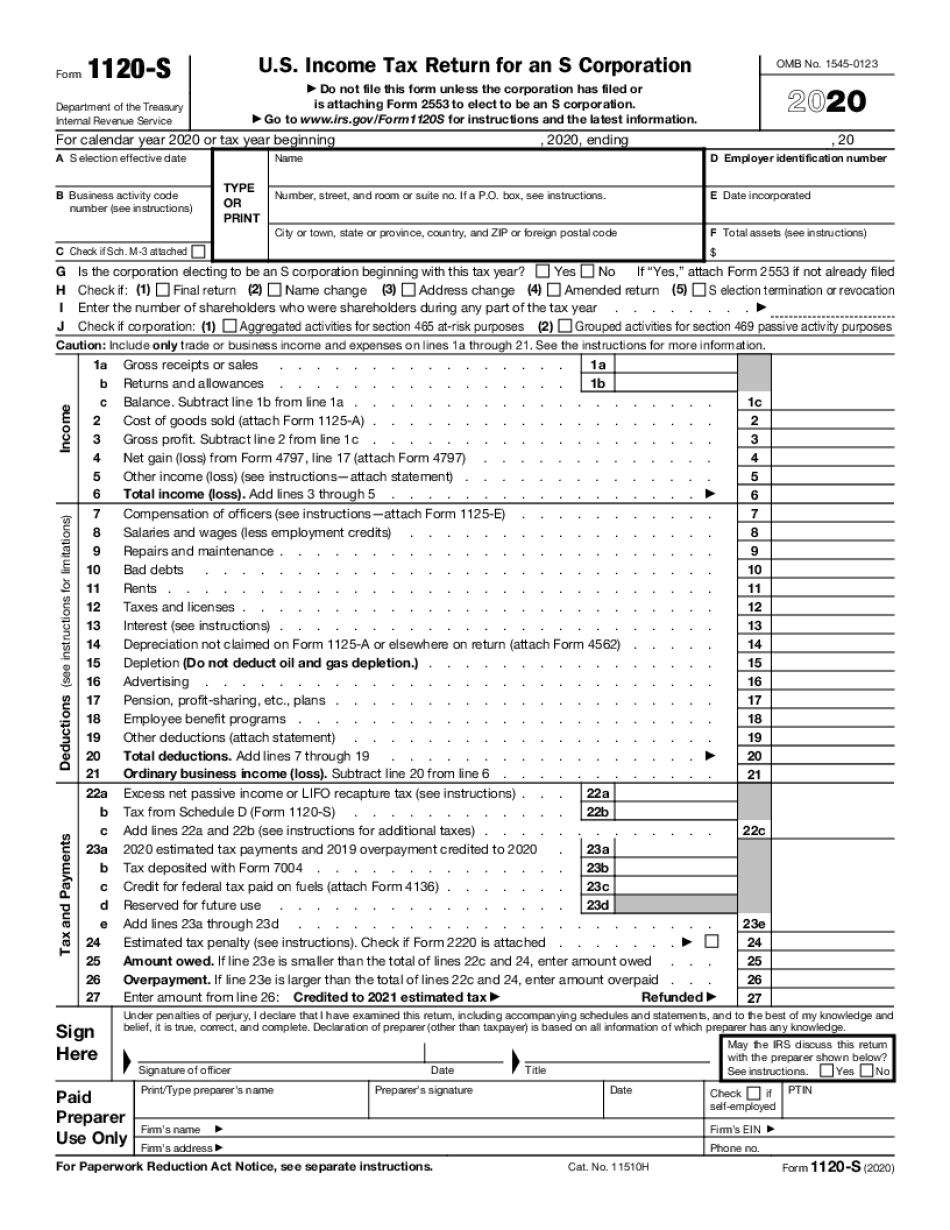

A company tax return is used to report your spending profits and corporation tax due to HMRC It involves completing a CT600 form and submitting a financial report with calculations that show how much you owe in tax Our guide to corporation tax has more on when to pay and how to register

Artists, writers, and designers frequently turn to Company Tax Return Example to start their imaginative projects. Whether it's sketching ideas, storyboarding, or planning a design format, having a physical template can be a valuable starting point. The adaptability of Company Tax Return Example allows designers to repeat and improve their job up until they achieve the wanted outcome.

How To Do Your Own Company Tax Return It s TAX SEASON Use Your Tax

How To Do Your Own Company Tax Return It s TAX SEASON Use Your Tax

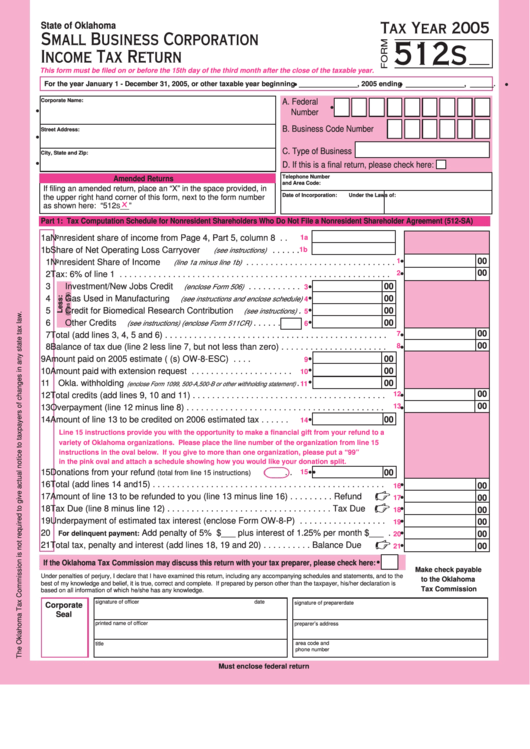

How to prepare a Company Tax Return for your limited company or unincorporated association deadlines corrections and penalties

In the expert realm, Company Tax Return Example offer an efficient method to handle tasks and jobs. From business strategies and project timelines to billings and cost trackers, these templates improve necessary company processes. In addition, they provide a substantial record that can be easily referenced throughout meetings and discussions.

Free Tax Prep Assistance And Forms At Birmingham Public Library

Free Tax Prep Assistance And Forms At Birmingham Public Library

Claim all of your allowable expenses Claim Capital Allowances R D tax relief If you run a business in the UK then you might need to submit a Company Tax Return and pay Corporation Tax on the profits that you make Tax can be a tricky subject so our article goes into more detail and covers What is Corporation Tax

Company Tax Return Example are widely utilized in educational settings. Teachers typically rely on them for lesson strategies, class tasks, and rating sheets. Students, too, can gain from templates for note-taking, research study schedules, and job preparation. The physical existence of these templates can boost engagement and work as substantial help in the understanding process.

Get More Company Tax Return Example

https://tax.thomsonreuters.com/blog/corporate-tax-return-filing

Determine the type of corporation 2 Determine tax deductions for write offs 3 Pay estimated taxes to the IRS 4 File federal return by due date 5 File state tax returns by due date 6 File local tax returns by due date 7 File international taxes for any business in other countries

https://www.simplybusiness.co.uk/knowledge/...

A company tax return is used to report your spending profits and corporation tax due to HMRC It involves completing a CT600 form and submitting a financial report with calculations that show how much you owe in tax Our guide to corporation tax has more on when to pay and how to register

Determine the type of corporation 2 Determine tax deductions for write offs 3 Pay estimated taxes to the IRS 4 File federal return by due date 5 File state tax returns by due date 6 File local tax returns by due date 7 File international taxes for any business in other countries

A company tax return is used to report your spending profits and corporation tax due to HMRC It involves completing a CT600 form and submitting a financial report with calculations that show how much you owe in tax Our guide to corporation tax has more on when to pay and how to register

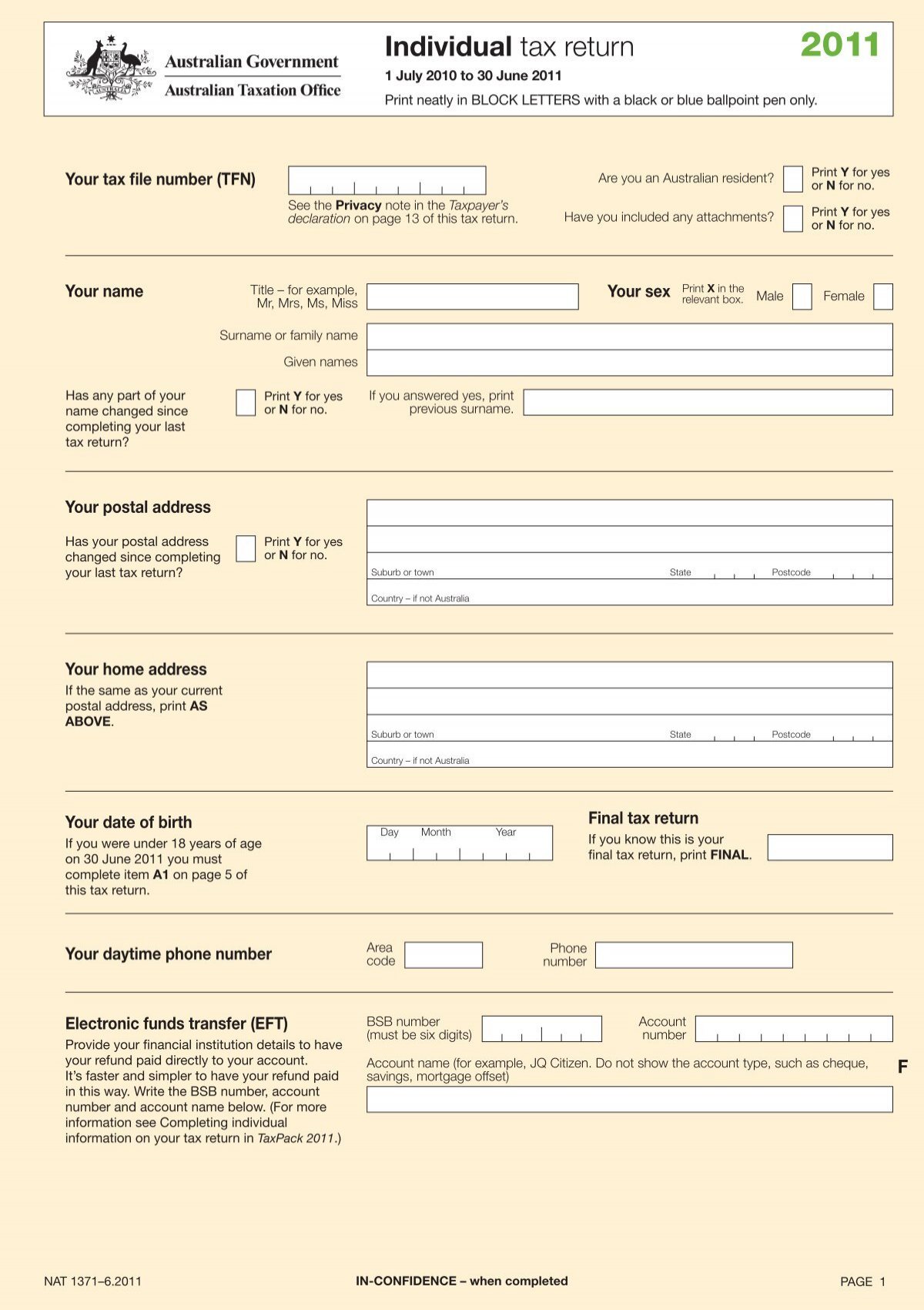

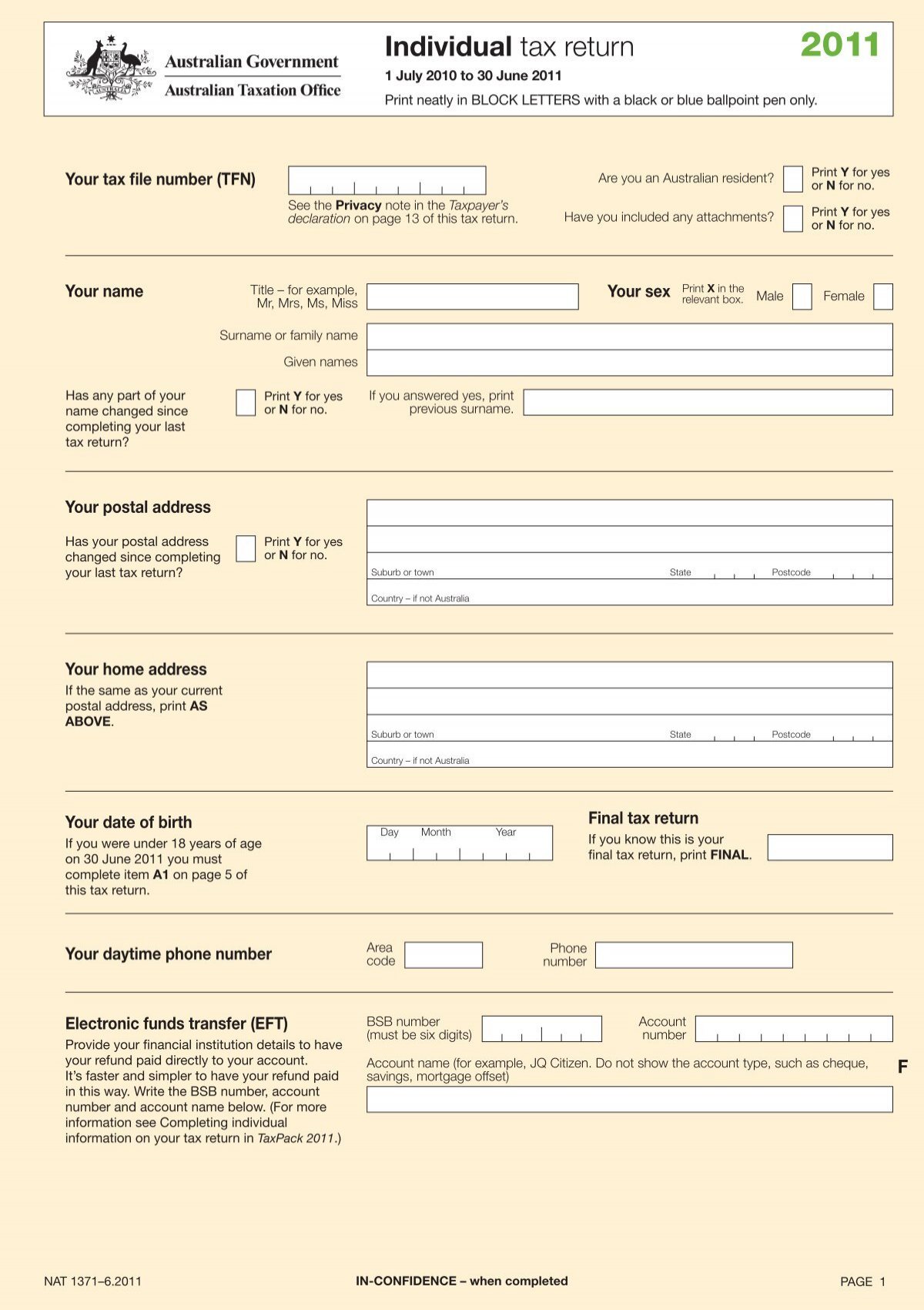

Individual Tax Return Australian Taxation Office

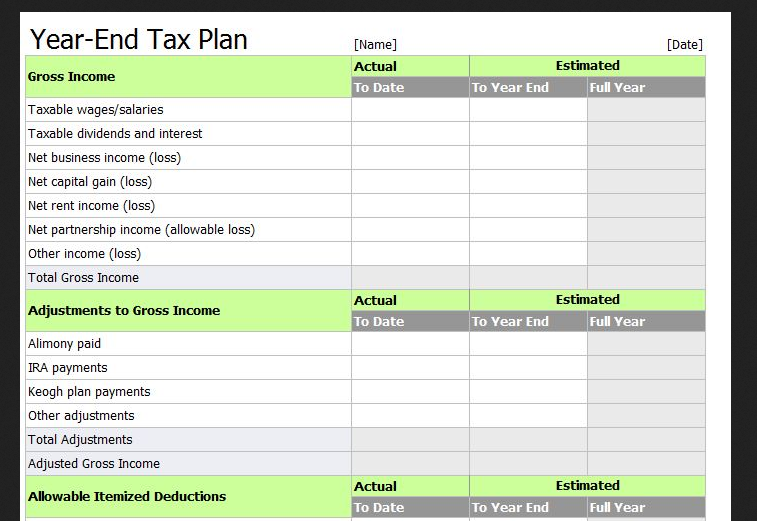

Tax Return Spreadsheet Template Uk Db excel

What Is EBITDA with Formula

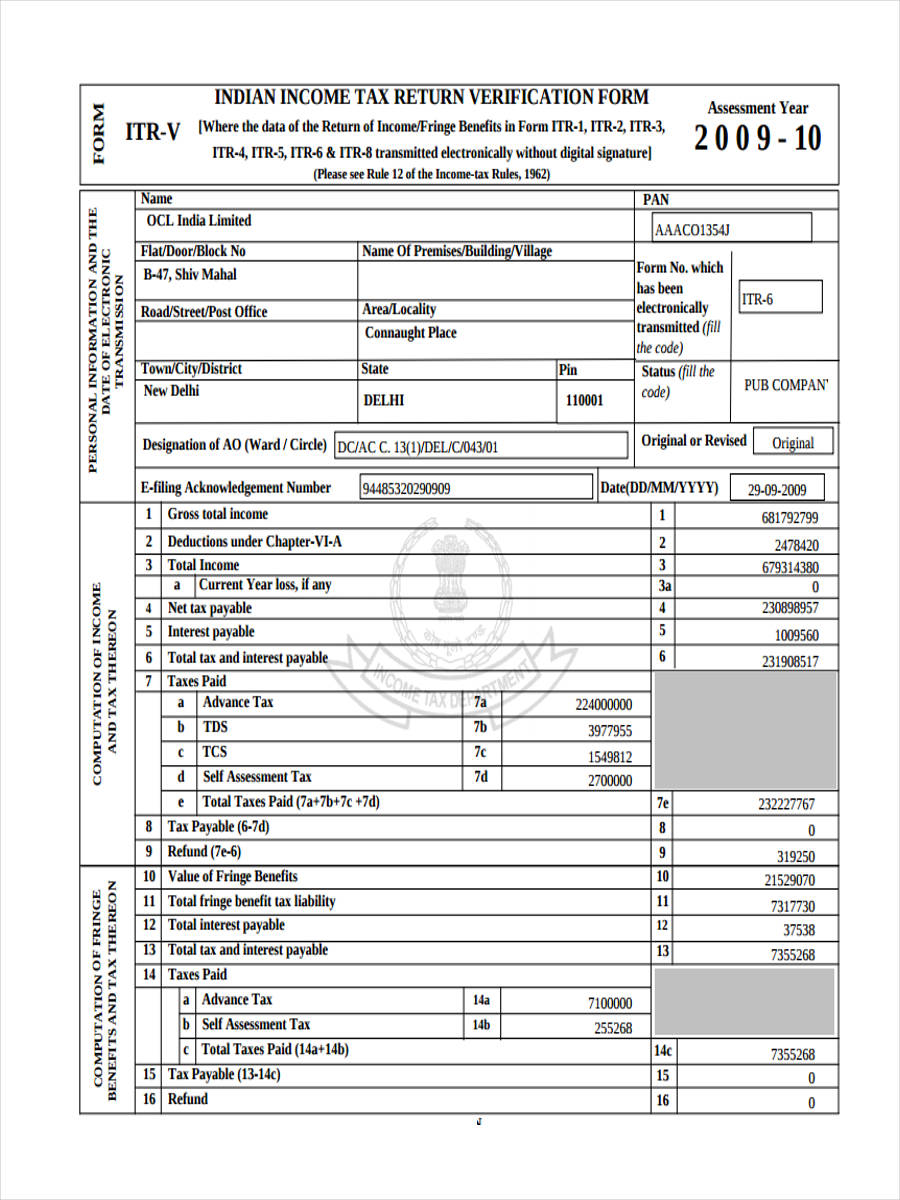

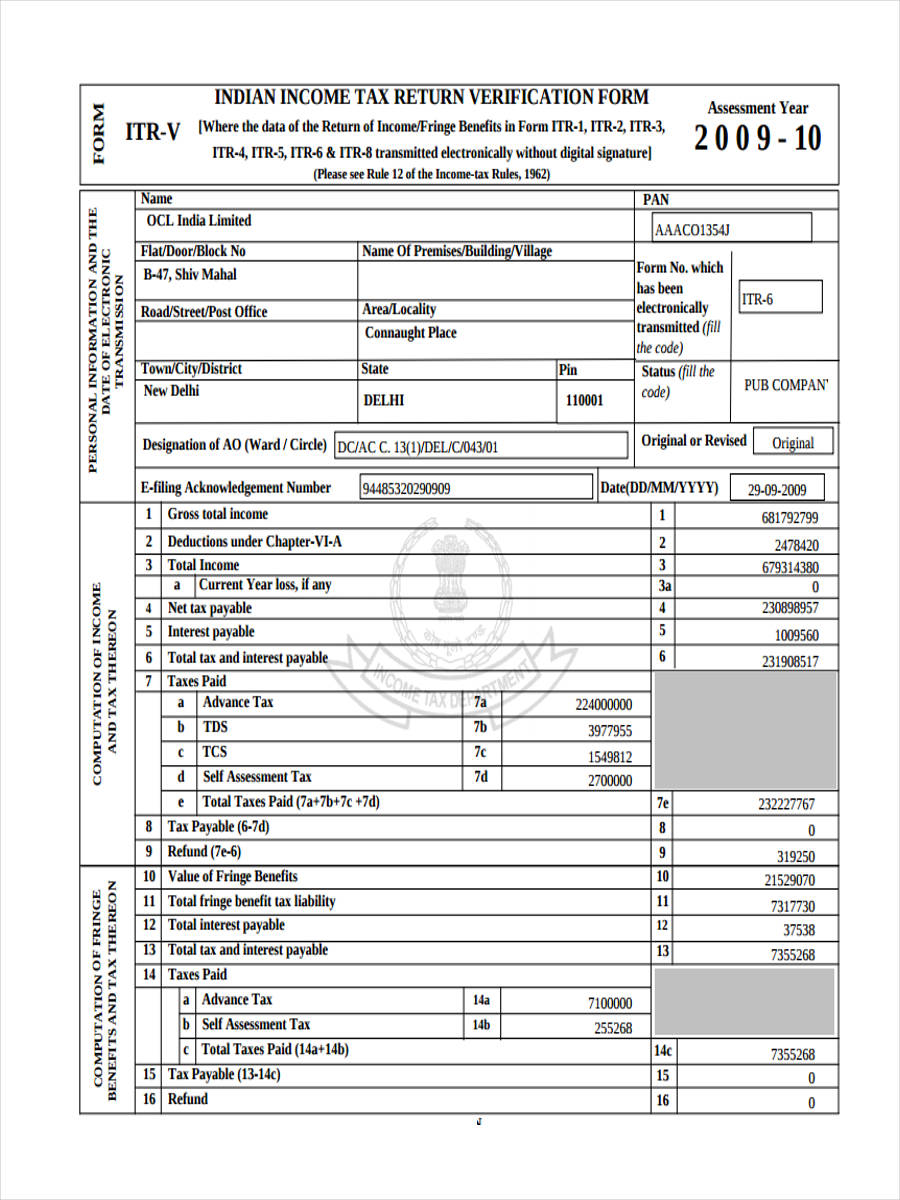

FREE 8 Sample Tax Verification Forms In PDF

How To Complete The 1040ez Tax Form Form Resume Examples xz20pMwM2q

Income Tax Format PDF Money Government Finances

Income Tax Format PDF Money Government Finances

Example Case Study 2 Australian Taxation Office